Bitcoin’s Quick Recovery

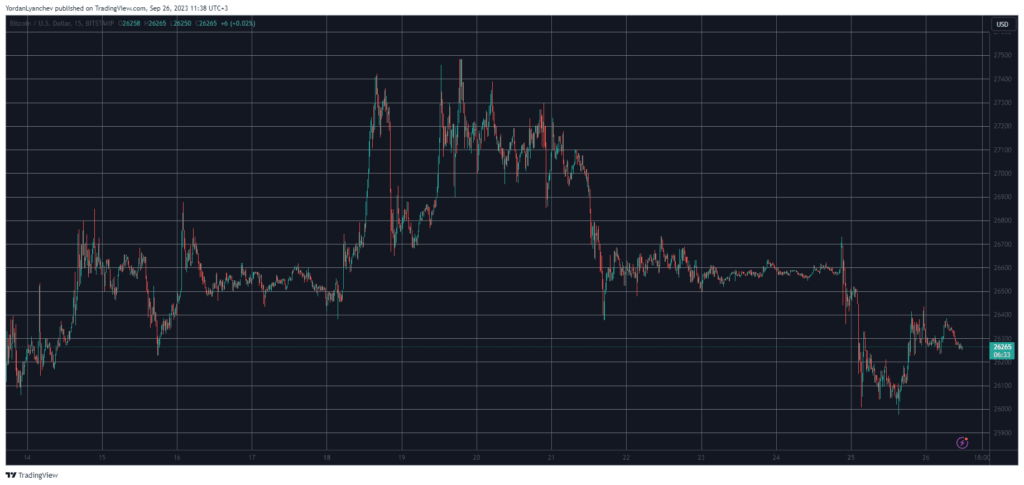

Bitcoin experienced a brief dip below the $26,000 mark yesterday. However, it swiftly bounced back after the revelation of MicroStrategy’s newest Bitcoin acquisition. This week, Bitcoin had reached a 20-day peak of $27,500. Despite maintaining proximity to this level for a while, it faced a decline towards the end of the business week, particularly post the US Fed’s latest FOMC meeting. This led to a decrease in its price to $26,400. However, the start of Monday saw a further decline, taking the cryptocurrency to a 12-day low, just shy of $26,000. This downtrend was interrupted when MicroStrategy publicized its recent Bitcoin procurement valued at nearly $150 million. This announcement spurred a positive reaction in the cryptocurrency, causing it to surge by several hundred dollars.

A Glimpse into the Broader Market

While Bitcoin remains the focal point, it’s essential to understand the broader market dynamics. Most altcoins, including Ethereum, Cardano, Binance Coin, Dogecoin, Tron, Polygon, and LEO, have shown modest gains. Ripple, in particular, has seen a 2% increase, positioning itself at $0.5. Other notable gainers include Bitcoin Cash with a 3.6% rise and Chainlink with a 3% increment. The standout performer among the top 100 is MakerDAO’s native token, MKR, which has surged by over 5%, nearing the $1,350 mark. Despite these movements, the total cryptocurrency market capitalization remains relatively stable, hovering around $1.050 trillion.

Reflecting on the Current Scenario

From my point of view, MicroStrategy’s consistent trust in Bitcoin, as evidenced by their recurrent acquisitions, showcases the potential and resilience of the cryptocurrency. This move, especially during a time when Bitcoin was experiencing a dip, not only reinforces the company’s confidence in the digital asset but also provides a semblance of stability to the market. On the flip side, it’s crucial to understand that while such purchases can induce short-term positive reactions, the long-term trajectory of Bitcoin and other cryptocurrencies remains influenced by a myriad of factors, including regulatory decisions, technological advancements, and market sentiment. As I see it, while the current market dynamics seem promising, investors should remain vigilant and informed.