About

us

The ability to use cryptocurrencies in retail

is breaking down barriers to global

interconnectivity across commerce

and society.

Mission

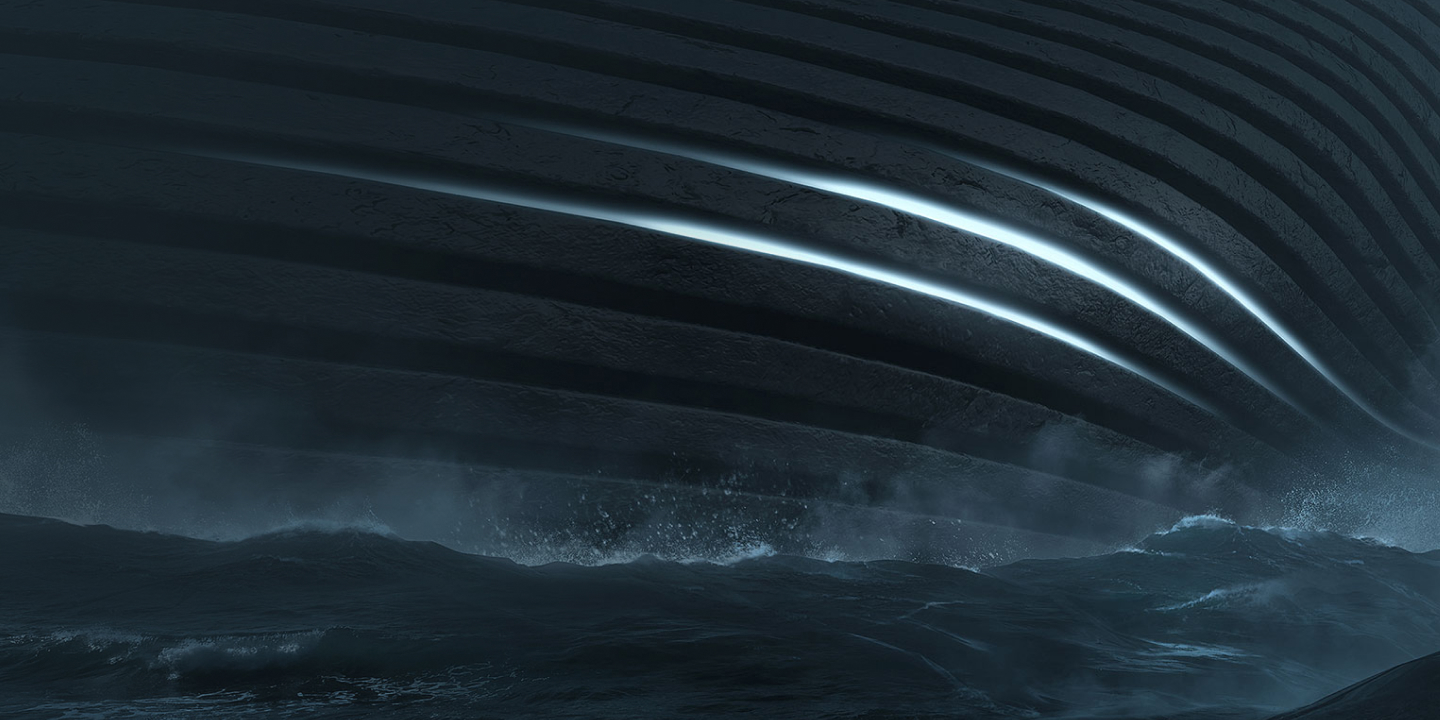

Lunu Pay is building an ecosystem to drive cryptocurrency adoption, highlighting money’s transformative role as a social connector and reshaping perspectives on its value in uniting communities.

The

Brand

Vision

Lunu Pay is more than an easy payment system driving crypto

adoption. We bring artistry to commerce — transforming transactions,

once merely functional, into moments of elegance. Within this vision

lies the beauty of the scientific effort invested

in its creation.

Blockchain technology and contemporary art share a fundamental concept important for life in the 21st century: the ability to connect fluidly beyond the limitations of cultures, religions, races, or creeds.

Lunu Pay is

an aspirational

brand

The

Tangibles

on innovation, fairness, and efficiency

in retail transactions

that redefine the standards of a new era

conversations, improve society, elevate brands, and enrich lives

The

Intangibles

the retail transaction a true exchange of energy and values