The Current State of BNB

Binance Coin (BNB), the native cryptocurrency of the Binance exchange, is currently experiencing a shift in momentum towards the bearish side. The bulls, who have been driving the price up, are beginning to feel the pressure. The key support level for BNB is at $230, with resistance at $260. The coin is currently stuck in a flat channel, a period of consolidation that often ends in a violent breakout once the price decides on a direction. Market participants are finding it challenging to break these key levels at this time.

The Potential Return of Sellers

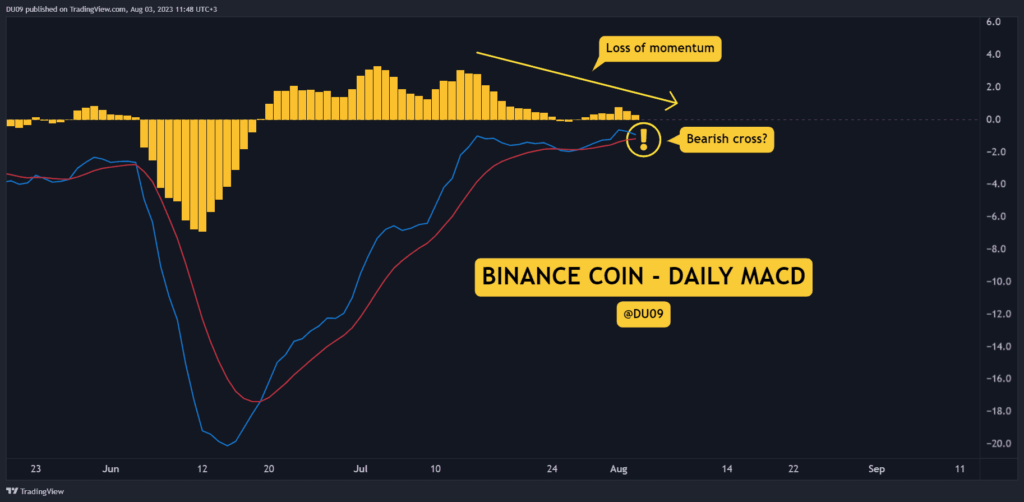

The latest daily candle for BNB is a bearish engulfing one, signaling that sellers may be gaining the upper hand. This is a concerning development, particularly as momentum appears to be shifting in their favor. If this trend continues, the key support level of $230 could soon be under significant pressure. The daily Moving Average Convergence Divergence (MACD), a trend-following momentum indicator, is already showing signs of weakness in the price action with a potential bearish cross on the horizon if buyers don’t return.

A Bearish Bias?

The bias for BNB is currently bearish. The key support continues to hold, but its resilience could soon be put to the test by the bears. If the support fails, BNB could potentially revisit the $200 mark in August. This would continue the downtrend that started in early June.

Personal Commentary

From my point of view, the current situation for BNB is a critical one. The bearish signals are concerning, especially for those who have invested in BNB. The potential for a bearish cross on the MACD is a clear sign of weakening momentum, which could lead to further price drops.

However, it’s important to note that the cryptocurrency market is notoriously volatile and unpredictable. While the current indicators suggest a bearish trend, a sudden influx of buyers could quickly reverse this. Therefore, investors should keep a close eye on the market and be prepared to react quickly to changes.

On the downside, if the key support level of $230 fails to hold, we could see a significant drop in the price of BNB. This could lead to a loss for investors, particularly those who bought in at higher prices. On the upside, if the support holds and buyers return, there could be potential for a rebound.

As I see it, the coming days will be crucial for BNB. Investors should be prepared for volatility and potential price swings. As always, it’s important to do your own research and make investment decisions based on your own risk tolerance and financial situation.