A Rollercoaster Day for Bitcoin

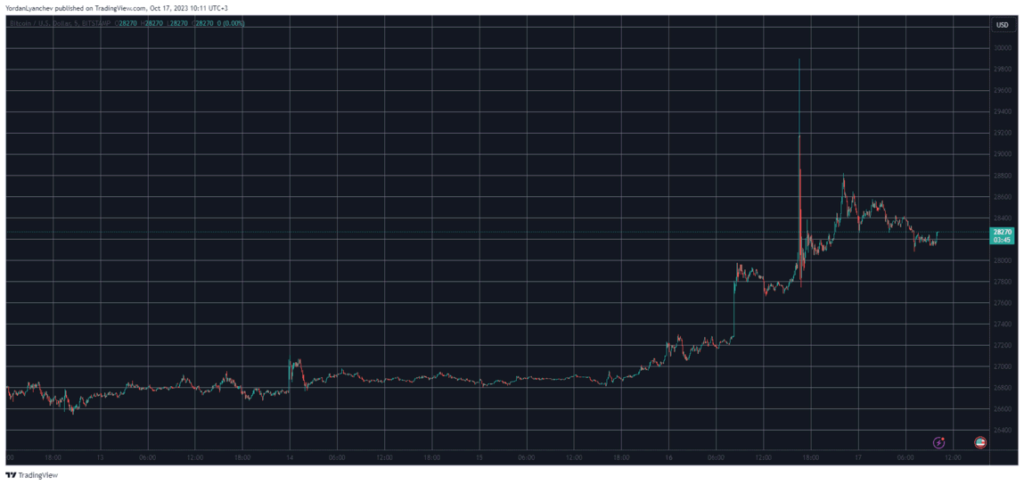

In an unexpected turn of events, Bitcoin experienced a significant surge, climbing over $2,000 within minutes, following reports that the U.S. Securities and Exchange Commission (SEC) had approved a spot Bitcoin Exchange-Traded Fund (ETF). However, the gains were short-lived as the news was soon debunked, sending Bitcoin back to its pre-surge levels, just above $28,000. This incident not only highlights the cryptocurrency’s volatility but also the market’s sensitivity to regulatory developments.

The Context: Bitcoin’s Sensitivity to News

The cryptocurrency market is known for its volatility, with prices often subject to sharp rises and falls. Bitcoin, despite being the most prominent cryptocurrency, is no exception. Its price can be significantly influenced by various factors, including market sentiment, major announcements, or regulatory news. In this case, the false information regarding the SEC’s approval of a Bitcoin ETF caused a temporary but dramatic spike in Bitcoin’s price.

The idea of a Bitcoin ETF has been a topic of interest for many investors for years. An ETF would potentially offer a more mainstream investment vehicle for Bitcoin, providing easier access for both institutional and retail investors. Therefore, any news on this front is closely watched by market participants, and as evidenced, can lead to substantial market movements.

Analyzing the Market’s Reaction

From my point of view, the market’s swift reaction to the ETF news, albeit false, underscores the eagerness and anticipation among investors for more regulated crypto investment avenues. The sharp rise and fall in Bitcoin’s price demonstrate how news (even if incorrect) can lead to significant market turbulence.

On the positive side, the incident highlights the high level of interest in cryptocurrency investments and the potential growth that could come with increased regulatory clarity. However, it also serves as a reminder of the risks involved, particularly with misinformation. Investors may need to brace for such volatility, especially as the regulatory environment for cryptocurrencies continues to evolve.

The quick retraction in Bitcoin’s price following the clarification also suggests a level of maturity in the market, as it shows that investors are closely monitoring and responding to legitimate news. This is a healthy sign, indicating that the market is not purely driven by speculation and can absorb and correct itself post misinformation.

In conclusion, while the false ETF approval news led to a temporary surge in Bitcoin’s price, it also provided valuable insights into the market’s dynamics and expectations. As the regulatory landscape becomes clearer and more stable, the market’s response to such developments will be crucial to watch for investors and regulators alike.