Bitcoin’s Recent Performance

Bitcoin, the world’s leading cryptocurrency, has been experiencing a period of low volatility in recent days. After a drop from over $27,000 to $26,400 following the US Federal Reserve’s FOMC meeting last Thursday, the cryptocurrency has been trading sideways. Over the weekend, Bitcoin’s price hovered around $26,600. Although there was a brief surge on Sunday evening, it was quickly countered, bringing the price back down to $26,000. Despite a minor dip below this level on Monday, the bulls managed to push the price back up. However, Bitcoin has struggled to surpass the $26,500 mark and has been hovering just above $26,000. This stability has kept its market capitalization at slightly over $510 billion, with its dominance over other altcoins just below 49%.

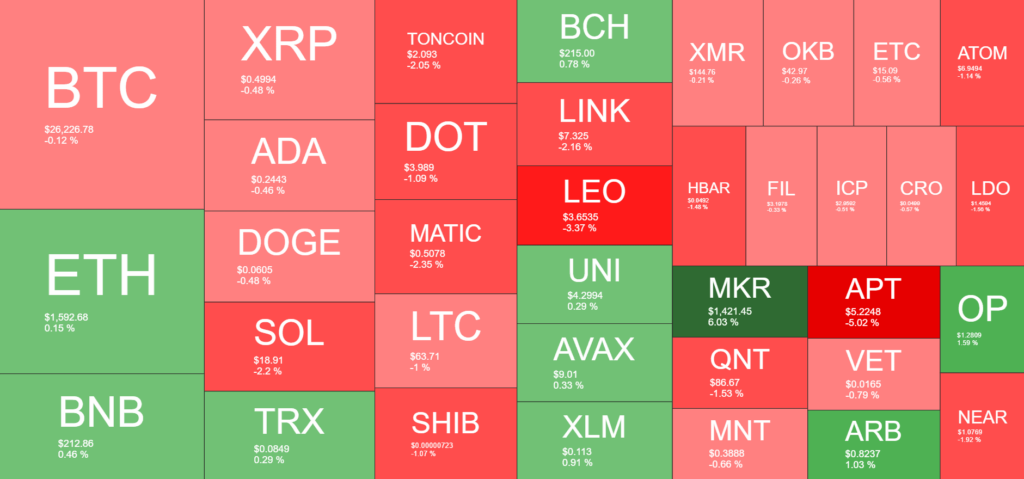

The Altcoin Landscape

While Bitcoin remains stable, the altcoin market has seen varied performances. Several major altcoins, including Ripple, Cardano, Dogecoin, and Litecoin, have experienced minor losses. Others, such as Toncoin, Polkadot, Polygon, Solana, Chainlink, and LEO, have seen drops of up to 3%. On the brighter side, Ethereum, Binance Coin, and Tron have recorded slight gains. The standout performer in the altcoin space is MakerDAO’s native token, MKR. It has surged by 6% in the last 24 hours and nearly 10% over the past week, trading well above the $1,400 mark. Despite these movements, the total cryptocurrency market capitalization remains relatively unchanged at just over $1.050 trillion.

A Personal Take on the Market Dynamics

From my point of view, Bitcoin’s stability, especially after significant events like the FOMC meeting, indicates a maturing market. While some may argue that the lack of volatility makes the market less exciting, it could also be seen as a sign of growing investor confidence and reduced speculation. As for MKR’s impressive performance, it’s a testament to the potential of decentralized finance (DeFi) projects. However, as with all investments, there are risks involved. The rapid surge in MKR’s price could be followed by equally swift corrections. Investors should always conduct thorough research and be aware of the market’s inherent volatility. On the whole, the current market dynamics offer both opportunities and challenges for seasoned and novice investors alike.