The Recent Surge in Cryptocurrency Values

The cryptocurrency market has recently witnessed a significant surge, with Avalanche (AVAX) leading the charge by soaring an additional 14%. Bitcoin (BTC), the primary cryptocurrency, has also made a notable comeback, returningф to the $42,000 mark. This development comes after a period of volatility and decline, where Bitcoin had slumped to just over $40,000 but managed to recover approximately two thousand dollars since then. Most altcoins mirrored this trend, but some, like Avalanche, have shown remarkable growth.

The Dynamics Behind Bitcoin’s Recovery

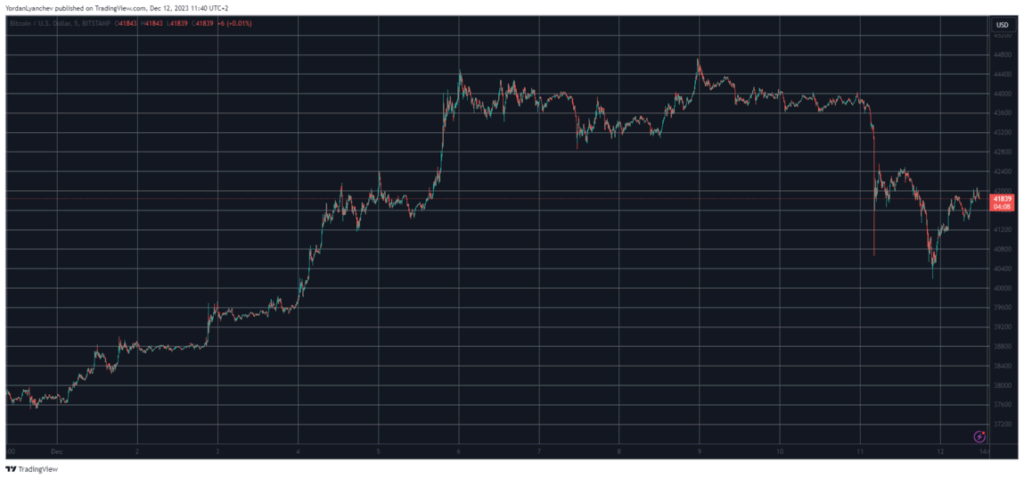

Bitcoin’s journey back to $42,000 was marked by a volatile yet positive week at the start of December, driving it from under $38,000 to a multi-month peak at $44,700. Despite a brief downturn, where it slumped to an 8-day low of $40,250, Bitcoin bounced back, with its market capitalization returning to $820 billion. However, its dominance over altcoins has taken a hit, now under 52%.

Avalanche’s Exceptional Performance

Avalanche stands out with a 14% surge, marking an over 80% increase in the past week, now trading at just over $40. This exceptional performance places AVAX in a league of its own, outpacing other major cryptocurrencies like Binance Coin, Cardano, and Polkadot, which have also seen significant gains.

Contextualizing the Crypto Market’s Movements

The cryptocurrency market’s volatility is not new, but the recent surge, especially in the case of AVAX and BTC, is noteworthy. This fluctuation is influenced by various factors, including investor sentiment, market trends, and global economic conditions. The recovery of Bitcoin and the surge in Avalanche’s value reflect a renewed investor confidence in the market, despite the ongoing challenges and uncertainties.

The Broader Impact on the Crypto Market

The total crypto market cap has recovered around $20 billion from its recent low but remains below $1.6 trillion. This recovery indicates a broader market stabilization, with altcoins like Binance Coin, Cardano, and Polkadot also experiencing gains. However, some cryptocurrencies like ETH, XRP, DOGE, TRX, and LINK have posted minor losses, highlighting the market’s selective response to different digital assets.

A Personal Perspective on the Market Trends

From my point of view, the recent surge in cryptocurrencies like AVAX and BTC is a positive sign for the market. It demonstrates resilience and the potential for growth even in uncertain times. However, it’s important to approach these developments with caution. The cryptocurrency market is known for its volatility, and while the current surge is encouraging, it’s crucial for investors to conduct thorough research and make informed decisions.

The Pros and Cons of Investing in Cryptocurrencies

Investing in cryptocurrencies can be highly rewarding, as seen in the recent gains of AVAX and BTC. However, the market’s inherent volatility also poses significant risks. The rapid fluctuations can lead to substantial gains, but equally, they can result in considerable losses. As I see it, potential investors should weigh these pros and cons carefully, considering their risk tolerance and investment goals before diving into the crypto market.

In conclusion, the cryptocurrency market’s recent dynamics, particularly the surge in Avalanche and Bitcoin, highlight both the opportunities and challenges within this evolving landscape. While the current trends are promising, a cautious and well-informed approach remains essential for anyone looking to invest in this sector.