A Sudden Spike: HBAR’s Rally and the BlackRock Effect

On April 24, 2024, the cryptocurrency market witnessed a significant price movement with Hedera’s token, HBAR, skyrocketing by 60%. This surge was initially attributed to a perceived endorsement from financial giant BlackRock, concerning their involvement with Hedera’s blockchain technology for tokenizing a money market fund. However, this was later clarified by Archax’s CEO, stating that BlackRock was not directly involved with Hedera. Despite this confusion, HBAR’s price remained elevated, showcasing the volatile nature of crypto assets influenced by market sentiments and news developments.

Background and Current Crypto Market Overview

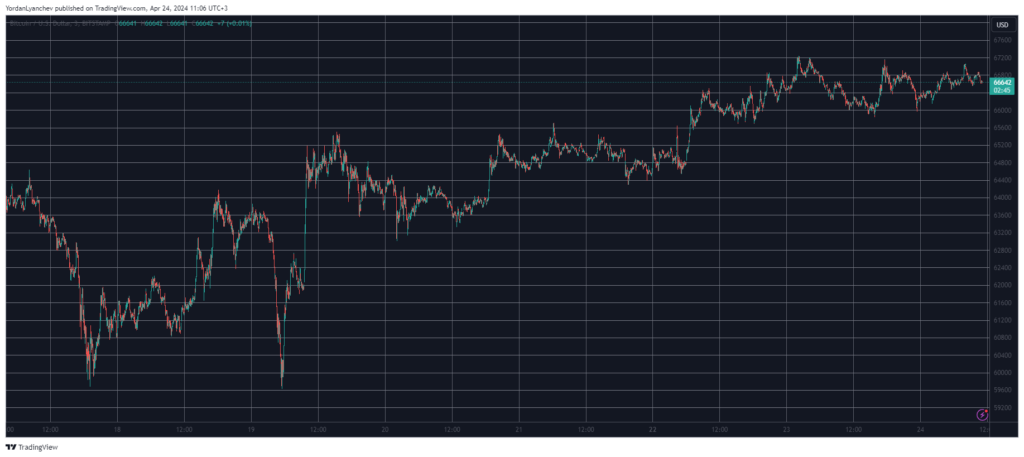

This event unfolds within a broader context of a robust crypto market, where Bitcoin (BTC) was aiming to breach the $67,000 mark but remained just shy of this target. The overall market cap of cryptocurrencies has approached $2.6 trillion, indicating a thriving ecosystem, albeit susceptible to rapid changes based on news and investor sentiment. The incident highlights the importance of verified information in the crypto space, where rumors can lead to substantial market movements.

Ethereum (ETH) and other altcoins also saw gains, further evidencing a generally bullish sentiment in the market. This situation underscores the interconnectedness of different cryptocurrencies and how developments in one can affect the broader ecosystem.

Personal Commentary: Navigating Information in Crypto Investments

From my perspective, the HBAR price incident serves as a critical reminder of the challenges and opportunities within the crypto market. Investors and traders must navigate through often unverified and rapidly spreading information that can significantly impact market prices.

Pros:

- Rapid Gains: Investors can benefit from quick gains as seen with HBAR, where significant price movements can offer high returns in short periods.

- Market Vibrancy: Such events keep the market dynamic and open opportunities for high-frequency traders and speculators.

Cons:

- Volatility: The same volatility can lead to substantial losses, as prices might correct just as quickly as they rise.

- Misinformation Risk: The potential for misinformation or misunderstanding announcements, as seen with the BlackRock confusion, can lead to misguided investment decisions.

In conclusion, while the crypto market offers substantial opportunities for gains, it also requires investors to be vigilant and informed. Understanding the source and validity of information is paramount in making sound investment decisions. Events like the HBAR price surge are testaments to the crypto market’s sensitivity to news and the need for a cautious approach in such a high-stakes environment.