The Sudden Shift in Crypto Dynamics

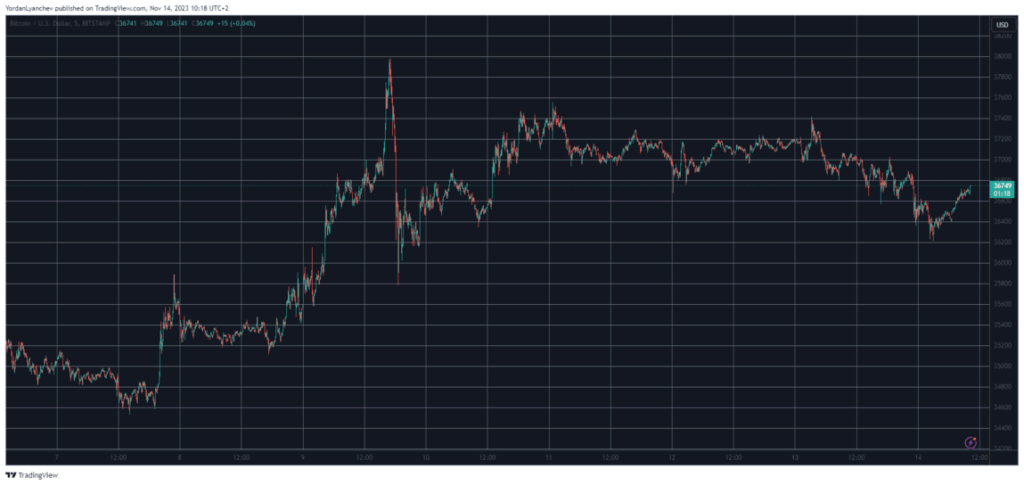

After a period of relative stability, the cryptocurrency market has taken a surprising turn. Bitcoin, the leading cryptocurrency, has notably dropped below the $37,000 mark. This decline is not isolated to Bitcoin alone; several altcoins, including Solana (SOL), Filecoin (FIL), Crypto.com Coin (CRO), and Aptos (APT), have also experienced a retraction of about 5%. This shift comes after a week of positive momentum, where Bitcoin had soared to $38,000, marking its highest value in 18 months. However, this surge was short-lived, as the currency faced a sharp decline, leading to significant liquidations among over-leveraged traders. Currently, Bitcoin’s market capitalization has fallen below $720 billion, with its dominance over altcoins slightly over 51%.

Background and Market Analysis

The cryptocurrency market is known for its volatility, and this recent downturn is a testament to that. Just last week, the market was buoyant, with Bitcoin reaching an 18-month high. This optimism was short-lived, as the market witnessed a sudden reversal. The decline in Bitcoin’s value was accompanied by a downturn in several altcoins. Notably, Solana, Filecoin, Aptos, and CRO each saw around a 5% decrease. In contrast, Polygon’s native token (MATIC) surged by 5.5%, demonstrating the unpredictable nature of the crypto market. This fluctuation has left the total crypto market capitalization slightly above $1.4 trillion.

A Balanced Perspective on the Market Shift

From my point of view, this recent downturn in the cryptocurrency market serves as a reminder of its inherent unpredictability and volatility. While the decline may concern investors, it’s important to consider the broader context. Cryptocurrencies have always been subject to rapid changes in value, often influenced by external factors such as regulatory news or technological advancements. On the positive side, this volatility can lead to significant gains for astute investors. However, it also poses a risk of substantial losses, particularly for those who are over-leveraged. It’s crucial for investors to conduct thorough research and exercise caution, especially in a market as unpredictable as cryptocurrency.

In conclusion, the recent downturn in the cryptocurrency market, particularly with Bitcoin and several altcoins, highlights the volatile nature of this digital asset class. While such fluctuations can offer opportunities for gain, they also underscore the risks involved in cryptocurrency investment. As the market continues to evolve, staying informed and cautious remains paramount for anyone involved in crypto trading.