The Unprecedented Surge

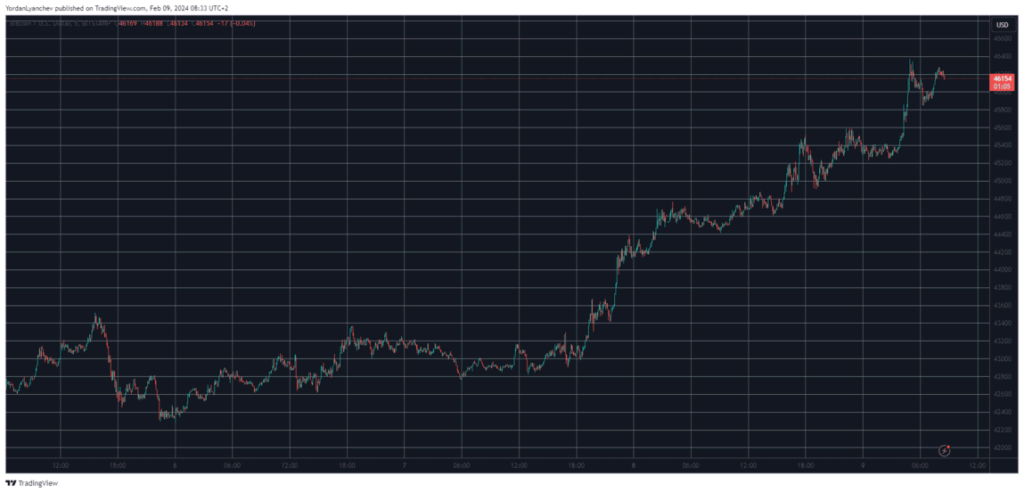

In a dramatic turn of events, Bitcoin has once again captured the financial world’s attention by skyrocketing past the $46,000 mark, an impressive feat that has left over $100 million in liquidations in its wake. This surge comes after a period of stagnation and a significant drop following the U.S. Securities and Exchange Commission’s (SEC) approval of nearly a dozen spot Exchange-Traded Funds (ETFs) on January 10. The primary cryptocurrency, which had seen a decline of over ten thousand dollars and bottomed out at $38,500 on January 23, has made a robust recovery. Over the past 48 hours, Bitcoin has seen gains of more than three thousand dollars, pushing its value to new monthly highs and causing a flurry of activity on trading platforms.

Context and Historical Perspective

This recent price movement is not just a simple market fluctuation; it represents a significant moment in Bitcoin’s history. After the SEC’s approval of spot ETFs, many expected the cryptocurrency market to stabilize. However, Bitcoin experienced a massive fall, leading to widespread speculation about its future. The recovery to over $46,000 is a testament to the cryptocurrency’s resilience and the bullish sentiment among investors. This event is particularly noteworthy given the backdrop of Bitcoin’s previous stagnation and the sharp decline following the ETF approvals. The climb to over $46,000 marks the first time Bitcoin has reached such heights since the ETF approvals, signaling a possible shift in market dynamics.

Moreover, the surge has not only affected Bitcoin but also had a ripple effect across the cryptocurrency market, with several altcoins, notably SOL and ADA, posting impressive gains. This period of volatility has been especially punishing for over-leveraged traders, with data from CoinGlass showing that 37,000 traders were liquidated in the past day, totaling $115 million in wrecked positions. Notably, more than $80 million of these liquidations came from short positions, highlighting the risks associated with betting against the market in such volatile conditions.

A Personal Take on the Surge

From my point of view, Bitcoin’s recent price movement is a double-edged sword. On one hand, it showcases the cryptocurrency’s potential for rapid growth and its ability to rebound from setbacks, reinforcing its position as a leading asset in the digital currency space. On the other hand, the extreme volatility and the significant liquidations highlight the inherent risks of cryptocurrency trading, particularly for those employing leverage without adequate risk management strategies.

The surge beyond $46,000 serves as a reminder of Bitcoin’s unpredictable nature and the speculative forces that drive the market. While the gains are a boon for long-term holders and bullish traders, they also underscore the precarious position of short sellers and the potential for sudden, sharp reversals. As the cryptocurrency market continues to evolve, this event will likely be remembered as a pivotal moment, offering valuable lessons on the dynamics of supply and demand, investor sentiment, and the impact of regulatory developments on digital assets.

In conclusion, Bitcoin’s recent surge is a complex event with far-reaching implications. It highlights the cryptocurrency’s resilience and the continued interest from investors, but also serves as a cautionary tale about the risks of over-leverage and market speculation. As we move forward, it will be interesting to see how this event influences Bitcoin’s trajectory and the broader cryptocurrency market.