The Unprecedented Rise of Bitcoin in 2023

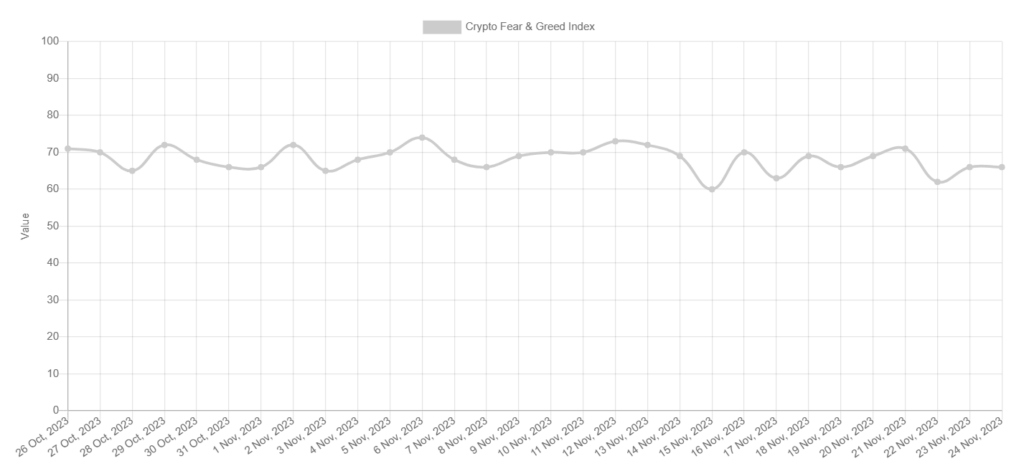

In a remarkable turn of events, Bitcoin has seen a staggering 120% increase in its value since the beginning of 2023. This surge has propelled the BTC Fear and Greed Index into a “Greed” zone for over 30 consecutive days, a phenomenon not witnessed since the final quarter of 2021. During that period, Bitcoin reached an all-time high of nearly $70,000. The index, which reflects investor sentiment, is influenced by various factors, including social media buzz, market momentum, and expectations surrounding the potential approval of a US BTC ETF and the upcoming 2024 halving.

Understanding the Market Dynamics

The cryptocurrency market’s bullish trend can be attributed to several key factors. Firstly, the anticipation of a spot BTC ETF in the United States has generated significant excitement among investors. Additionally, the upcoming Bitcoin halving, scheduled for spring 2024, is expected to further fuel market momentum. This event historically leads to a reduction in the supply of new bitcoins, often resulting in a price increase.

However, this surge in greed among investors also raises concerns about a potential market correction. The Fear and Greed Index suggests that the current market condition might be driven more by the “Fear of Missing Out” (FOMO) than by fundamental value. This scenario aligns with Warren Buffett’s investment strategy, which advises being “fearful when others are greedy and greedy only when others are fearful.”

A Balanced Perspective on Bitcoin’s Future

From my point of view, while the current market trend showcases Bitcoin’s resilience and the growing investor interest in cryptocurrencies, it also highlights the volatile and speculative nature of this asset class. The prolonged period of greed could be a precursor to a market correction, as history has often shown that extreme market sentiment, whether positive or negative, tends to be followed by a reversal.

On the flip side, the potential approval of a BTC ETF in the U.S. and the upcoming halving could provide solid grounds for Bitcoin’s value appreciation. These events could attract more institutional investors, lending credibility and stability to the cryptocurrency market.

In conclusion, while the current “Greed” phase in the Bitcoin market indicates strong momentum and investor confidence, it also serves as a reminder of the inherent risks and volatility in cryptocurrency investments. Investors should approach this market with caution, balancing their enthusiasm with a healthy dose of skepticism. As the landscape evolves, it will be crucial to monitor market trends closely and make informed decisions based on a comprehensive understanding of the underlying factors driving these changes.