Bitcoin’s Price Movement and Market Dynamics

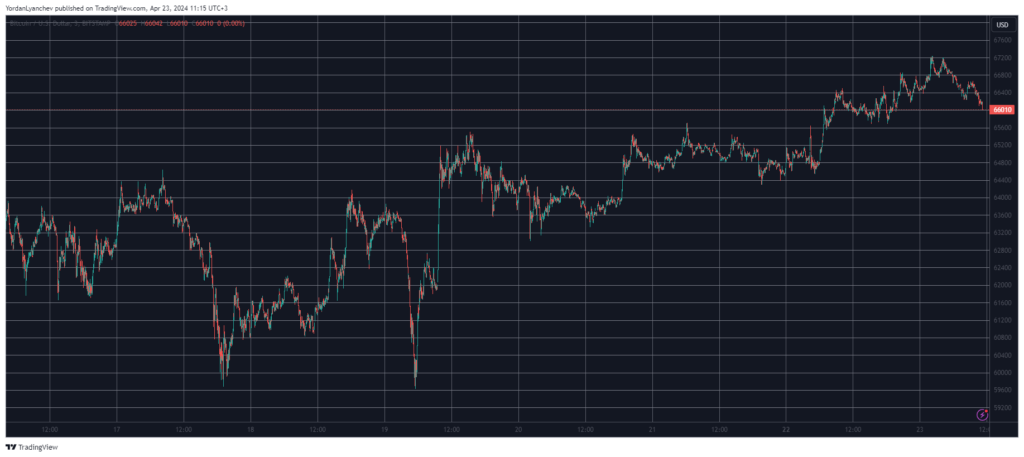

Bitcoin recently surged past $67,000 but encountered strong resistance that nudged its price downwards. This price fluctuation comes after a brief dip below $60,000 last week, sparked by geopolitical tensions. However, Bitcoin managed a swift recovery as fears of immediate escalation diminished, bringing its price to about $65,000 just before the much-anticipated fourth halving event on April 20. Since then, Bitcoin has seen modest daily gains, peaking at $67,200 before losing momentum and settling just above $66,000. The cryptocurrency’s market capitalization remains robust at $1.3 trillion, maintaining a 51% dominance over other cryptocurrencies.

Altcoin Market and Toncoin’s Struggle

Parallel to Bitcoin’s rollercoaster, the altcoin market has shown mixed results. While most major altcoins have registered minor losses, Ripple’s XRP notably gained 3% amidst recent positive developments in its ongoing SEC lawsuit. Conversely, Toncoin has experienced a significant downturn, plunging by 10% over the past 24 hours to a current price of around $5.5. This decline follows an initial surge after Tether expanded two of its stablecoins onto Toncoin’s blockchain, which initially had a positive impact on its market price.

Analyzing the Crypto Market’s Current State

From my perspective, the crypto market is exhibiting typical volatility, with Bitcoin demonstrating resilience in maintaining key price levels despite external pressures and brief pullbacks. The situation with Toncoin, however, highlights the vulnerabilities associated with altcoins, which can experience sharp declines even amidst seemingly favorable developments like strategic partnerships.

The contrast between Bitcoin’s robustness and Toncoin’s volatility underscores a broader market trend: major cryptocurrencies like Bitcoin and Ethereum tend to have more stability and slower, more predictable price movements compared to smaller altcoins, which can be more susceptible to dramatic swings based on news and market sentiment. As investors and enthusiasts in the cryptocurrency space, these dynamics should inform strategies—diversifying investments and keeping a keen eye on market signals is crucial. While Bitcoin may offer a safer harbor, the potential high rewards from altcoins come with higher risks, necessitating more vigilant management and realistic expectations of market behavior.