A Sudden Shift in the Crypto Market

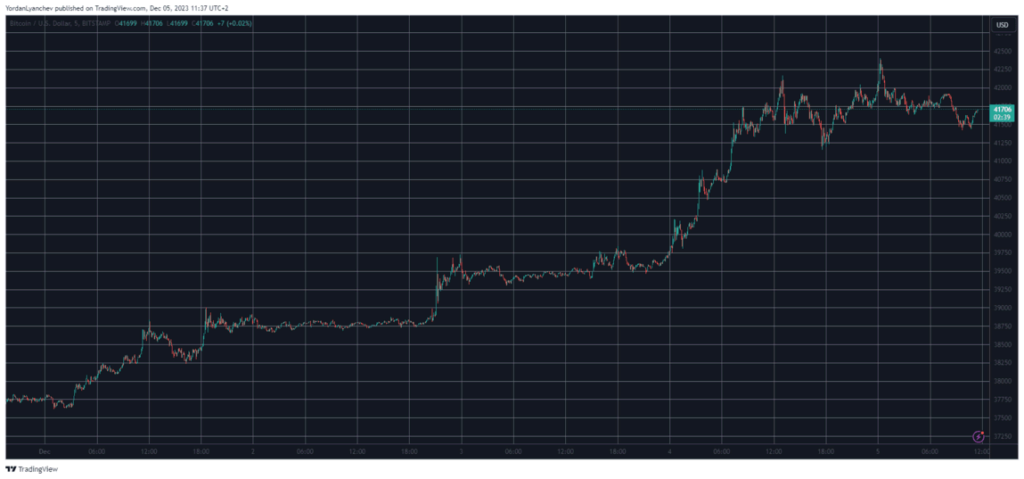

In a dramatic turn of events, Bitcoin (BTC), the flagship cryptocurrency, recently soared to $42,400, marking its highest value in over 18 months. This surge, however, was short-lived as it soon retraced to just below the $42,000 threshold. This fluctuation in Bitcoin’s value is a significant development, considering its struggle below $38,000 at the start of the month. The rapid gain in value, which began on a Saturday, saw Bitcoin breaking above $40,000 for the first time since May 2022. Despite the slight pullback, Bitcoin’s market capitalization remains robust, exceeding $810 billion, with its dominance over altcoins reaching 53%.

In contrast, most altcoins are currently experiencing a downturn. Ethereum and Binance Coin, for instance, have both seen declines of around 2%. Other major cryptocurrencies like Cardano, Tron, Avalanche, and DOGE have also dropped by similar percentages. Solana (SOL) has experienced the most significant decline among the larger-cap altcoins, falling by more than 6%.

The Underlying Factors and Market Dynamics

The recent movements in the cryptocurrency market are reflective of the volatile nature of digital assets. Bitcoin’s impressive rally can be attributed to several factors, including increased institutional interest and favorable market sentiments. The cryptocurrency’s ability to rebound from its previous lows indicates a resilient market, albeit susceptible to rapid changes.

The decline in altcoins, while Bitcoin surged, suggests a shift in investor focus towards more established cryptocurrencies during times of market uncertainty. This trend is not uncommon in the crypto space, where investors often gravitate towards Bitcoin as a ‘safe haven’ during turbulent times.

Analyzing the Market’s Direction

From my perspective, the recent developments in the cryptocurrency market highlight the complex interplay of investor sentiment, market dynamics, and external economic factors. The rise and subsequent fall of Bitcoin’s value underscore the inherent risks and opportunities within the crypto market. While the surge in Bitcoin’s price is a positive sign for investors and enthusiasts, the volatility that follows cannot be overlooked.

The decline in altcoins, particularly Solana, points to a broader market correction, possibly driven by investors cashing in on recent gains. However, the standout performance of Stacks (STX), which skyrocketed by over 30%, indicates that opportunities for significant gains still exist within the altcoin sector.

In conclusion, while Bitcoin’s recent price movement is a testament to its enduring appeal, the volatility of the crypto market remains a critical factor for investors. The contrasting fortunes of Bitcoin and altcoins like Solana and Stacks highlight the diverse investment strategies and risk appetites within the crypto community. As the market continues to evolve, staying informed and cautious will be key for those navigating this dynamic investment landscape.