The Sudden Surge: Analyzing the Recent Crypto Market Boom

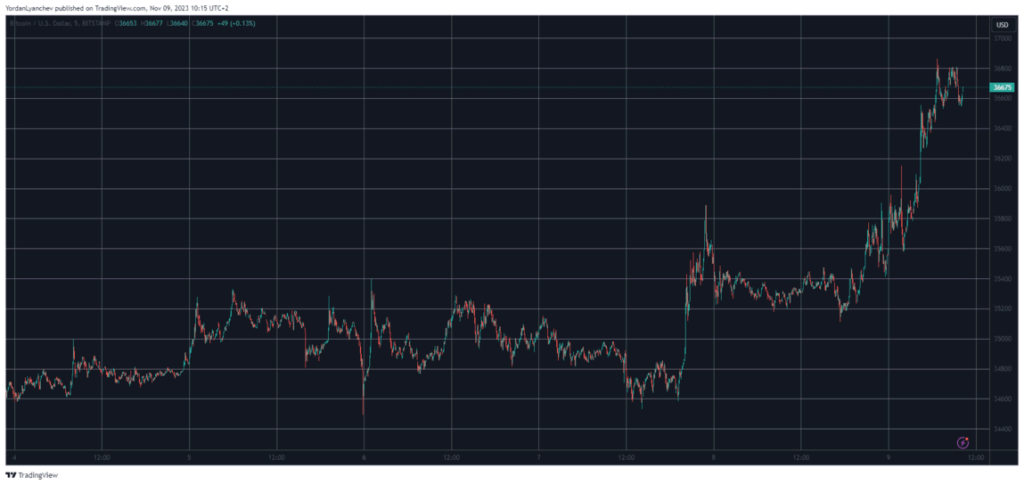

In an unexpected overnight market movement, the cryptocurrency sector witnessed a staggering $50 billion increase in value, with Bitcoin leading the charge to an 18-month high. The primary cryptocurrency, which had been relatively stagnant, soared by over $1,500 in just 24 hours, peaking near the $37,000 mark. This surge not only signifies Bitcoin’s highest valuation since early May 2022 but also propels the total market capitalization close to $1.4 trillion. The altcoin sector followed suit, with notable gains from LINK, MATIC, and others, while Bitcoin’s market dominance remains strong, slightly above 52%.

Behind the Bull Run: Contextualizing the Crypto Rally

The recent bullish trend can be traced back to a few days prior when Bitcoin faced a bearish downturn, slipping to $34,500. However, the market’s resilience was quickly demonstrated as the bulls intervened, preventing further declines. The subsequent offensive by Bitcoin was not an isolated event; it was mirrored by altcoins, which often exhibit more pronounced movements in response to Bitcoin’s volatility. Among the top performers, KAS surged by 22%, and other major cryptocurrencies like Ethereum, Binance Coin, and Ripple also experienced significant gains. This collective uptrend has pushed the total crypto market cap to a remarkable $1.38 trillion, according to CoinMarketCap.

A Balanced Perspective on the Crypto Phenomenon

From my point of view, while the current market rally brings a wave of optimism to the crypto community, it’s essential to maintain a balanced perspective. The pros of such a surge are evident: increased investor confidence, potential for high returns, and a reinforced argument for cryptocurrencies as a legitimate asset class. However, the cons warrant attention too; the market remains highly volatile, with the possibility of sudden downturns, and the risk of investment bubbles forming cannot be ignored.

The recent liquidation of over $140 million due to the price spike is a testament to the market’s unpredictability. Investors should remain cautious, conduct thorough research, and not be swayed by the fear of missing out on the next big rally. As I see it, while the current trends are promising, the crypto market’s history of volatility calls for a prudent investment approach.

In conclusion, the crypto market’s overnight boom is a significant event that has reinvigorated the digital currency landscape. It highlights the dynamic and unpredictable nature of this burgeoning sector. As the market continues to evolve, it will be interesting to observe whether this surge is a harbinger of sustained growth or a temporary peak in the ever-fluctuating world of cryptocurrency.