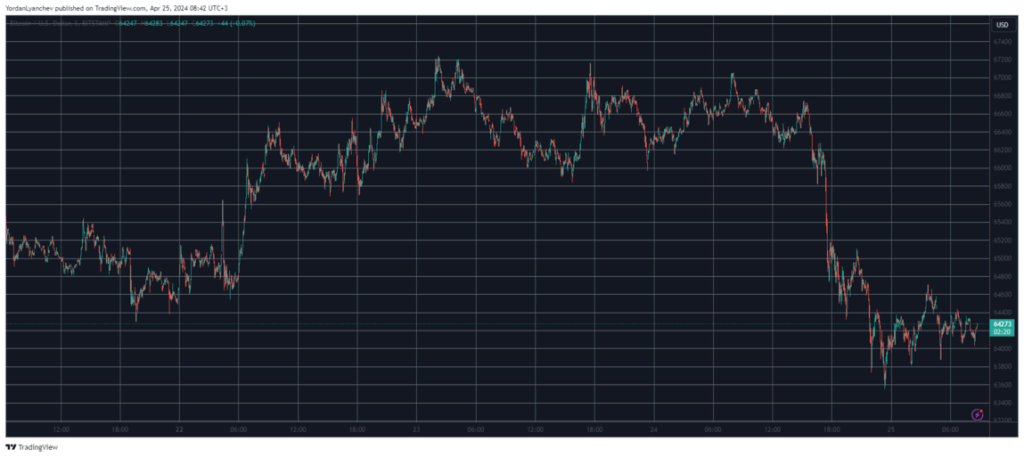

Market Shock as Bitcoin Dives Below $64,000

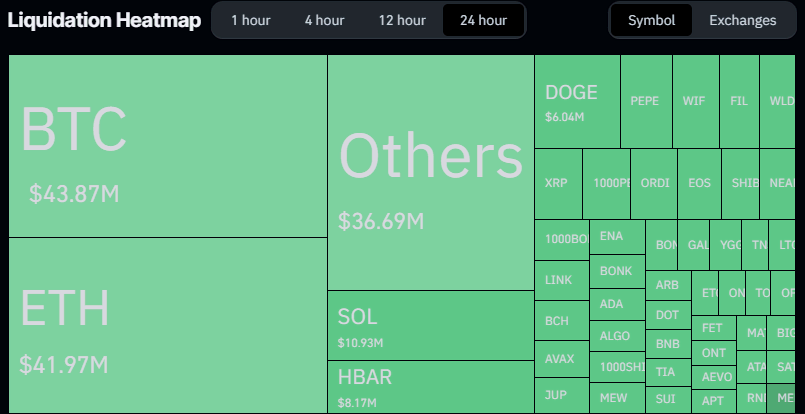

Recently, Bitcoin experienced a significant drop, falling below the $64,000 mark, which triggered a massive wave of liquidations exceeding $200 million. This event marks a turbulent period for the cryptocurrency, as just days prior, Bitcoin had been trading above $66,000 and had even briefly touched $67,000. The downturn not only impacted Bitcoin but also led to substantial losses across various altcoins, intensifying the market’s volatility.

Background and Impact on Traders

The decline in Bitcoin’s price occurred amidst geopolitical tensions between Iran and Israel, though the situation appeared to stabilize temporarily. Despite this, the market’s reaction was swift and severe, affecting nearly 100,000 traders, most of whom held long positions. The sharp decrease in value also led to significant price drops in other cryptocurrencies like Solana, Dogecoin, and Avalanche, with declines ranging from 7% to 10%. This situation underscores the fragile nature of cryptocurrency markets, where investor sentiment can shift dramatically based on both market dynamics and external geopolitical events.

Personal Commentary on the Crypto Market’s Future

From my perspective, this incident illustrates the inherent risks associated with leveraged trading in the volatile crypto market. While high leverage can offer substantial returns, it also increases the potential for steep losses, as evidenced by the recent liquidations. This volatility is not only a risk for individual investors but can also affect the broader market stability.

Looking ahead, the crypto market’s future remains uncertain with potential for both growth and significant downturns. Investors should consider more cautious strategies, particularly in times of geopolitical stress or market turbulence. Diversifying investments and setting stricter loss limits could be wise to mitigate risks associated with sudden market drops.

The recent events serve as a reminder of the crypto market’s unpredictability and the need for investors to maintain a balanced and informed approach to trading and investment. This situation might also prompt regulators to look more closely at crypto market practices, especially concerning leveraged trading.