The Struggle Around $29,000

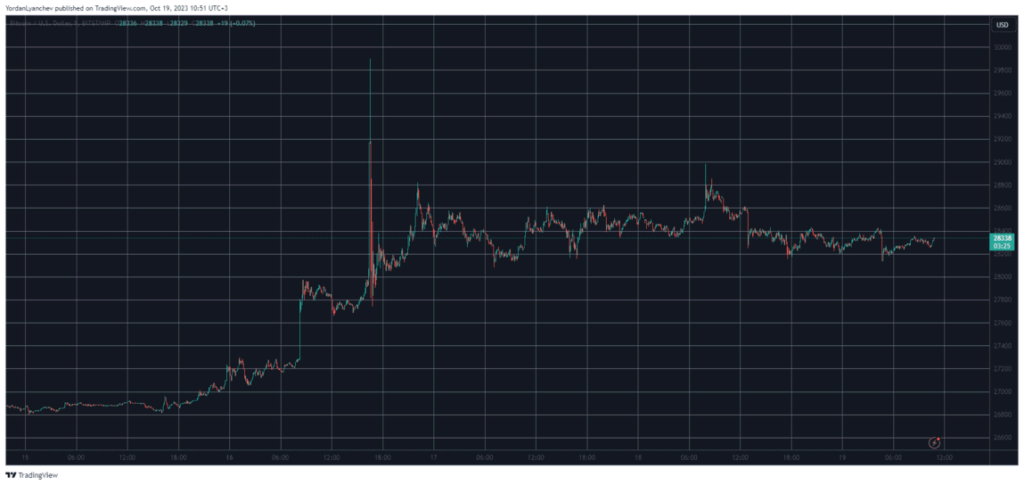

Bitcoin, the leading cryptocurrency, recently attempted to breach the $29,000 mark but faced rejection, subsequently losing some value. However, it has managed to hold its position above $28,000. This event occurred amidst a whirlwind of market activities, including false reports of the US SEC approving a Bitcoin ETF, which led to a brief surge before a sharp correction. While Bitcoin shows resilience, many larger-cap altcoins, except for LEO, UNI, and MNT, are experiencing losses, with XRP and ADA leading the downward trend with about a 2% drop.

Historical Context: The ETF Buzz and Market Reaction

The cryptocurrency market is no stranger to volatility, often influenced by news and global financial developments. The recent buzz around the potential approval of a Bitcoin ETF by the US SEC sent ripples through the market. This speculation led to a significant, albeit brief, surge in Bitcoin’s price, touching a 2-month peak of around $30,000. However, as the reports were debunked, the asset retraced its steps back to $28,000. This incident highlights the market’s sensitivity to news and regulatory developments, underscoring the speculative nature of cryptocurrency investments.

A Personal Take: Navigating the Crypto Seas

From my point of view, the cryptocurrency market’s reaction to the unconfirmed news of the Bitcoin ETF approval is a testament to the market’s speculative nature and sensitivity to regulatory movements. While Bitcoin’s resilience in holding a $28,000 support level amidst these fluctuations is commendable, the performance of altcoins raises concerns.

Pros:

- Bitcoin’s ability to rebound and hold a significant support level indicates strong market confidence and a potential buffer against future dips.

- The incident underscores the importance of regulatory milestones, such as ETF approvals, in bolstering cryptocurrency adoption and enhancing market maturity.

Cons:

- The sharp, news-driven market reaction highlights the prevalence of speculation and the potential for misinformation to trigger significant volatility.

- The declining value of prominent altcoins signals a possible lack of investor confidence in these assets, potentially hinting at a broader market consolidation or a shift in investor focus towards Bitcoin.

As I see it, while the market’s enthusiasm for positive regulatory developments is understandable, investors must exercise caution. The sharp swings based on unverified news underscore the importance of due diligence and the need for investors to stay abreast of reliable news sources. Furthermore, the contrasting performance between Bitcoin and altcoins suggests investors are possibly favoring the former’s perceived stability, raising questions about the altcoin market’s medium-term outlook.