The Unpredictable Nature of Digital Currencies

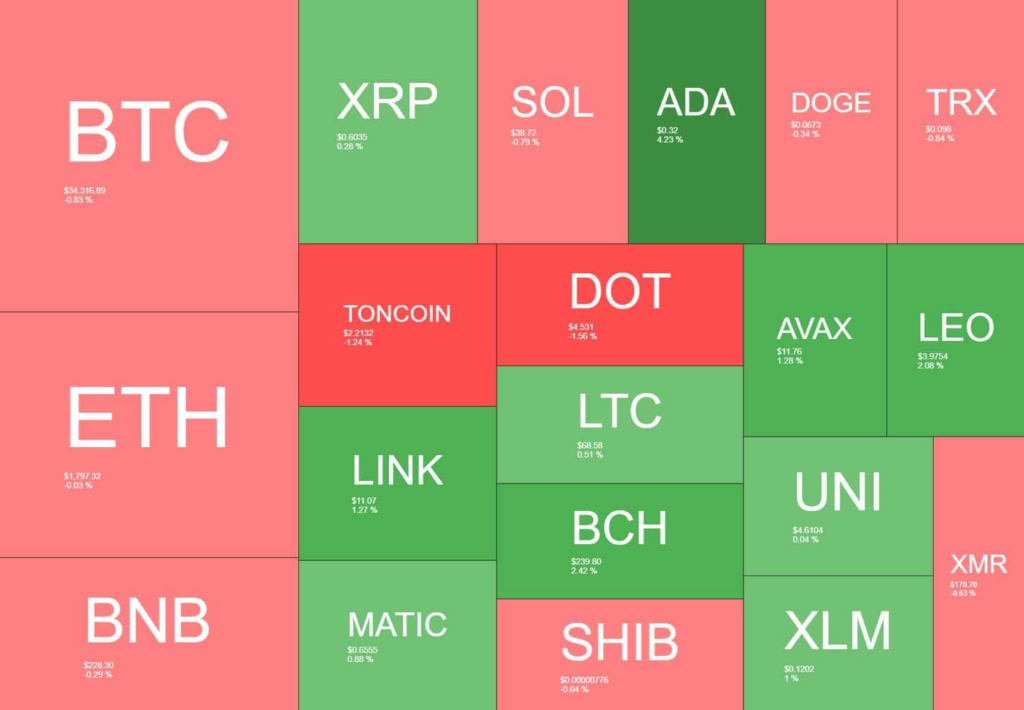

In a startling turn of events, the cryptocurrency market has witnessed a significant downturn, with Bitcoin plummeting towards the $34,000 mark and Solana (SOL) experiencing an 11% drop overnight. This sudden shift has resulted in a 2% decrease in the total market capitalization, reflecting the volatile essence of digital currencies. Bitcoin, which had been on an upward trajectory, aiming to breach the $36,000 threshold—a level not seen in approximately 18 months—saw its momentum halted, leading to a 3.1% decline within 24 hours.

The market’s volatility was further highlighted by Bitcoin’s dominance index, a measure of its market share relative to other cryptocurrencies, which fell by 0.3% to 50.7%. This suggests that, despite Bitcoin’s struggles, altcoins have managed to fare slightly better during this tumultuous period. However, not all altcoins have been fortunate, with Solana taking a significant hit, its price falling below $40.

Behind the Numbers: Analyzing the Market Movement

The cryptocurrency market is no stranger to rapid fluctuations, and the latest price movements are a testament to the unpredictable nature of these digital assets. Bitcoin’s inability to sustain its bullish run and Solana’s abrupt price drop are indicative of the market’s sensitivity to a myriad of factors, including investor sentiment, regulatory news, and technological developments.

From my point of view, the current market conditions underscore the inherent risks associated with cryptocurrency investments. While the potential for high returns exists, the market’s unpredictability can just as quickly lead to substantial losses. Investors must navigate this landscape with caution, balancing the lure of potential gains with the reality of the market’s volatility.

A Balanced Perspective on Market Dynamics

The recent downturn in the cryptocurrency market serves as a reminder of the delicate balance between risk and reward in the world of digital currencies. While some investors may view the dip as a buying opportunity, others might see it as a warning sign to reassess their investment strategies.

As I see it, the market’s current state presents a dual-edged sword. On one hand, the decrease in Bitcoin’s price could be seen as a correction, potentially paving the way for future growth. On the other hand, the sharp decline could also signal underlying issues that could lead to further instability.

In conclusion, the cryptocurrency market’s latest movements provide a clear illustration of its volatile nature. While the allure of digital currencies remains, it is crucial for investors to approach the market with a well-informed strategy, recognizing the potential for both significant gains and losses. As the market continues to evolve, staying abreast of trends and developments will be key to navigating the unpredictable waters of cryptocurrency investment.