The Underwhelming Launch of Bitcoin ETF and Overheated Crypto Markets

Bitcoin’s recent price trajectory has been a rollercoaster, with a significant 16% drop from its January 11th highs of $48,500, now teetering close to the crucial $40K mark. This decline has sparked widespread discussions about the potential reasons behind this downturn and the future of Bitcoin’s value.

The Underwhelming ETF Launch

The much-anticipated launch of the spot Bitcoin exchange-traded fund (ETF) in the U.S. was met with a series of hiccups. Despite years of efforts by ETF providers and the eventual green light from the U.S. Securities and Exchange Commission, the launch was anything but smooth. A compromised SEC account led to false tweets about the ETF’s approval, causing a chaotic bidirectional price spiral and the liquidation of leveraged positions worth millions. Although Bitcoin’s price soared to $48,500 post-announcement, the ETF inflows failed to offset the selling pressure, contributing to the current downward trend.

Overheated Crypto Markets

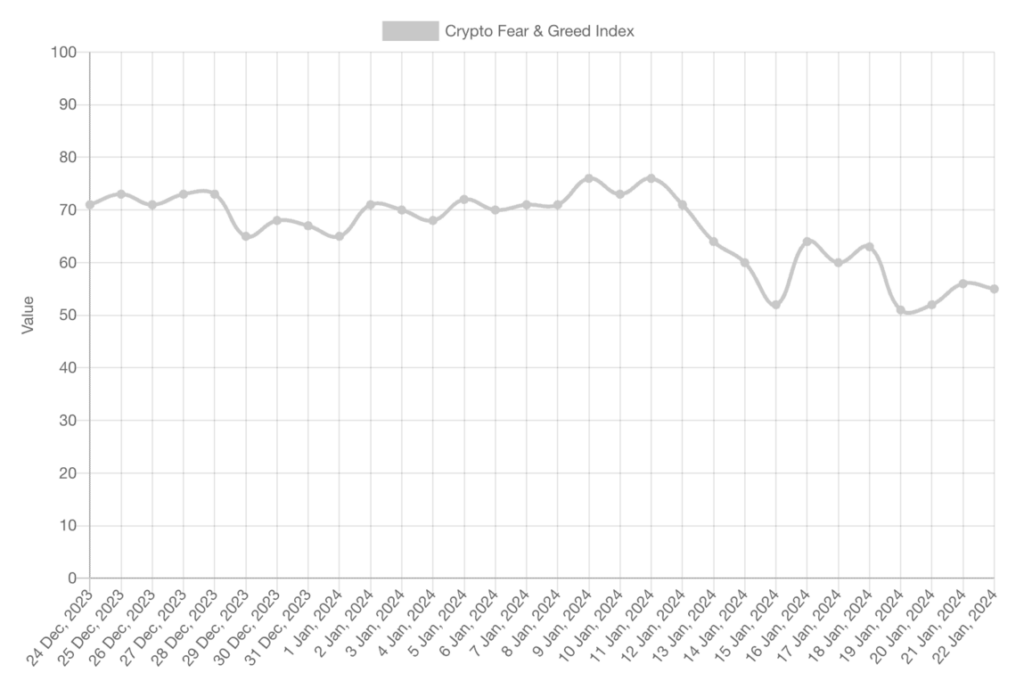

Prior to the current decline, the cryptocurrency markets experienced a prolonged period of upward trend without significant corrections, largely driven by the anticipation of the spot BTC ETF approval. This surge, as depicted in CoinGecko’s charts, saw Bitcoin’s price jump by about 86% from around $26K in mid-October to its January peak. However, indicators like the Crypto Fear & Greed Index had been signaling an overheated market for some time, with trends hovering in the ‘Greed’ or ‘Extreme Greed’ categories, reflecting an overly enthusiastic market sentiment.

Personal Commentary: Navigating the Bitcoin Volatility

From my perspective, the recent Bitcoin price fluctuations underscore the inherent volatility and unpredictability of cryptocurrency markets. The underwhelming ETF launch highlights the sensitivity of Bitcoin’s price to regulatory and market developments, while the overheated market conditions point to the emotional and speculative nature of cryptocurrency investments.

Pros:

- The ETF’s launch, despite its initial issues, marks a significant milestone in Bitcoin’s mainstream financial integration.

- Historical patterns, such as the upcoming Bitcoin halving event in April, have traditionally preceded major bull markets, suggesting potential future gains.

Cons:

- The market’s overreaction to regulatory news and developments indicates a high level of speculation and emotional trading in the crypto space.

- The failure of the ETF inflows to counterbalance selling pressure raises concerns about the sustainability of Bitcoin’s price in the face of market manipulations and rumors.

In conclusion, while the Bitcoin market continues to offer high-reward opportunities, it remains fraught with risks and uncertainties. Investors should approach with caution, keeping in mind the market’s susceptibility to external influences and speculative behaviors.