The Sudden Crypto Market Decline: A Detailed Analysis

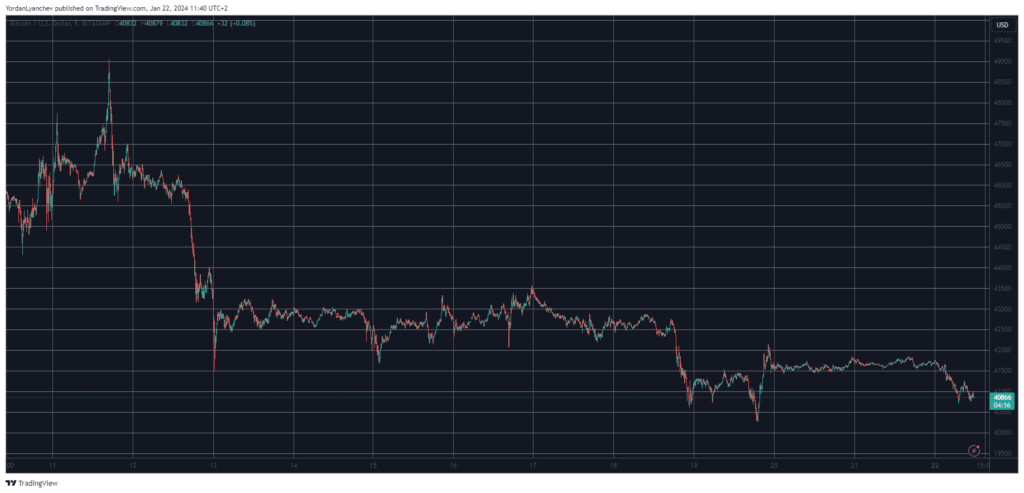

After a period of relative stability, the cryptocurrency market experienced a significant downturn, with Bitcoin’s value dropping below the $41,000 mark. This decline led to a staggering $40 billion loss in the market’s overall value. The primary cryptocurrency, Bitcoin, faced heightened volatility following the US Securities and Exchange Commission’s approval of 11 spot BTC ETFs. This approval initially caused Bitcoin’s value to surge past $49,000, a peak it hadn’t reached in nearly two years. However, the excitement was short-lived as Bitcoin slumped, losing over $7,000 in value. The following week saw Bitcoin trading sideways, with minor fluctuations, until a sharp drop to $40,200 marked a monthly low. Despite a slight recovery, Bitcoin struggled to maintain its value around $42,000.

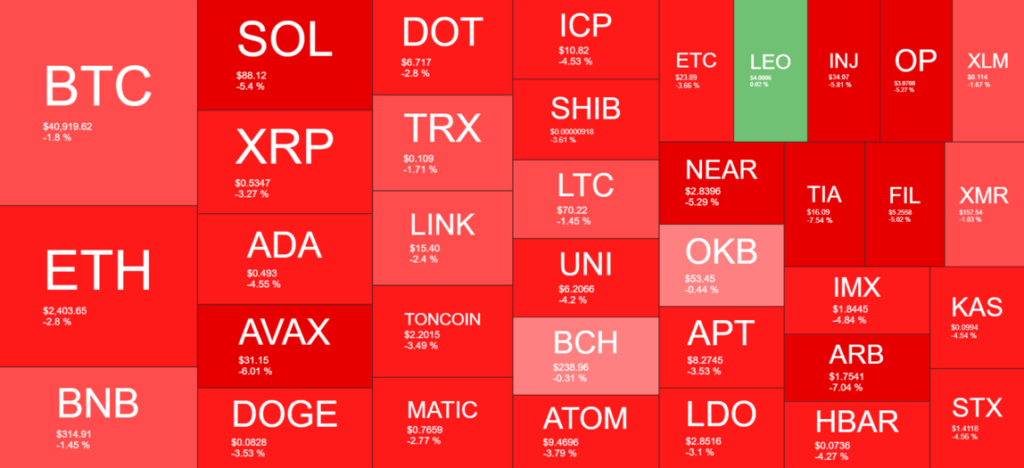

The impact wasn’t limited to Bitcoin. Most alternative coins, including prominent ones like Solana (SOL) and Avalanche (AVAX), followed suit, experiencing declines of more than 5%. Ethereum (ETH), Binance Coin (BNB), Ripple (XRP), Cardano (ADA), Dogecoin (DOGE), and Polkadot (DOT) also saw significant losses. The cumulative effect of these declines resulted in the crypto market’s value plummeting to $1.6 trillion.

Contextualizing the Crypto Market’s Volatility

The recent downturn in the crypto market is a stark reminder of its inherent volatility. The initial surge in Bitcoin’s value, following the SEC’s approval of BTC ETFs, highlights the market’s sensitivity to regulatory developments. The subsequent decline underscores the challenges in sustaining such gains. This pattern of rapid growth followed by a sharp decline is not new in the crypto world. It reflects the speculative nature of these assets and the market’s reaction to external factors like regulatory changes, global economic conditions, and investor sentiment.

The broader impact on alternative cryptocurrencies indicates a strong correlation within the market, where altcoins often mirror Bitcoin’s trajectory. This interdependency suggests that while diversification is possible within the crypto market, it is not immune to systemic risks.

A Balanced Perspective on the Crypto Market’s Future

From my point of view, the recent events in the crypto market serve as a critical reminder of the risks associated with investing in digital currencies. While the approval of BTC ETFs by the SEC was a positive development, signaling increasing mainstream acceptance, it also brought to light the market’s vulnerability to regulatory decisions. The rapid decline in Bitcoin’s value following its initial surge is a testament to the market’s speculative nature.

On the one hand, the growth potential of cryptocurrencies, especially with increasing institutional interest, cannot be ignored. On the other hand, the market’s volatility poses significant risks to investors. It’s essential for investors to approach cryptocurrency with caution, recognizing both its potential for high returns and its susceptibility to sudden downturns.

In conclusion, while the crypto market continues to offer exciting opportunities, it demands a careful and informed approach to investment. The recent downturn is a reminder of the need for regulatory clarity and the importance of investor education in navigating this dynamic market.