The Resurgence of Bitcoin and Altcoins

In a striking turn of events, the cryptocurrency market has witnessed a significant rebound, with Bitcoin (BTC) clawing its way back to the $43,000 mark after a series of declines. This resurgence is not isolated to Bitcoin alone; most altcoins have also seen a notable increase in value. Among them, Chainlink (LINK) has emerged as the standout performer, boasting an impressive 16% increase in its daily trading price. This rally has propelled LINK to trade at around $18, marking a significant milestone for the cryptocurrency.

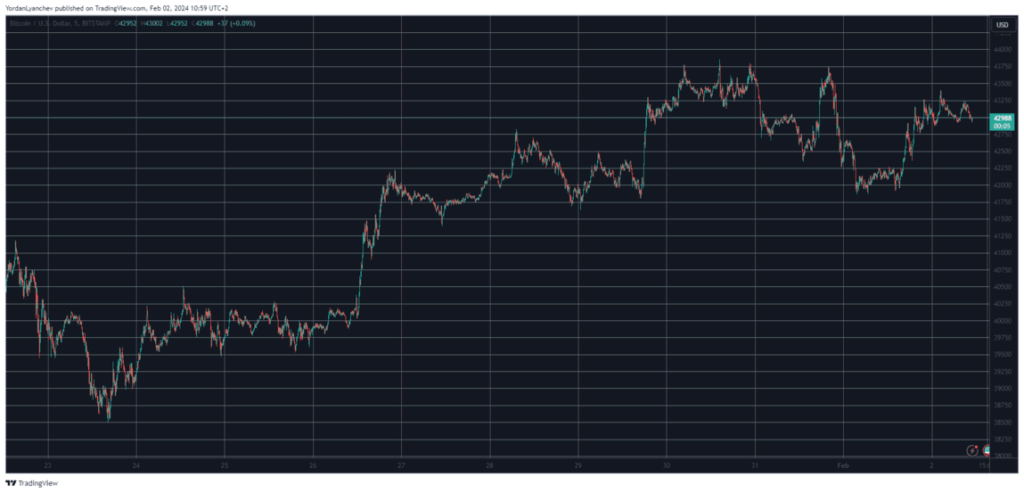

The recovery of Bitcoin to $43,750, albeit briefly, before a slight retraction, showcases the volatile nature of the crypto market. This fluctuation was influenced by the latest US Federal Reserve announcement on monetary policy, which initially led to a dip in Bitcoin’s value. However, the market’s resilience was on full display as Bitcoin quickly recovered, surpassing the $43,000 threshold once again.

Unpacking the Market’s Momentum

The crypto market’s overall capitalization has experienced a substantial boost, gaining $30 billion overnight and reaching a total of $1.650 trillion. This surge is indicative of the growing investor confidence and the bullish sentiment permeating the market. Other cryptocurrencies, including Ethereum (ETH), Binance Coin (BNB), Solana (SOL), Avalanche (AVAX), and Cardano (ADA), have also enjoyed gains, further highlighting the widespread recovery across the board.

This market rally is particularly noteworthy for Chainlink, which has outperformed several of its peers with a 16% surge. This remarkable performance underscores the increasing interest and optimism surrounding LINK, positioning it as a key player in the current market upswing.

A Personal Perspective on the Crypto Rally

From my point of view, the recent upturn in the cryptocurrency market, especially the significant gains seen by Chainlink, is a testament to the dynamic and resilient nature of digital assets. While Bitcoin’s recovery to $43,000 is a positive sign for the market’s overall health, LINK’s 16% increase is particularly compelling. It not only highlights the potential for altcoins to achieve substantial growth but also signals a broader market trend towards diversification and the increasing value investors place on different cryptocurrencies.

However, it’s essential to approach this market with caution. The volatility inherent in cryptocurrency investments means that while there are opportunities for significant returns, there are also substantial risks. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions.

In conclusion, the current rally in the cryptocurrency market, led by Chainlink’s impressive performance, offers a glimpse into the potential future trajectory of digital assets. As the market continues to evolve, it will be interesting to see how these trends develop and what they mean for the broader financial landscape.