The Sudden Drop in Crypto Valuations

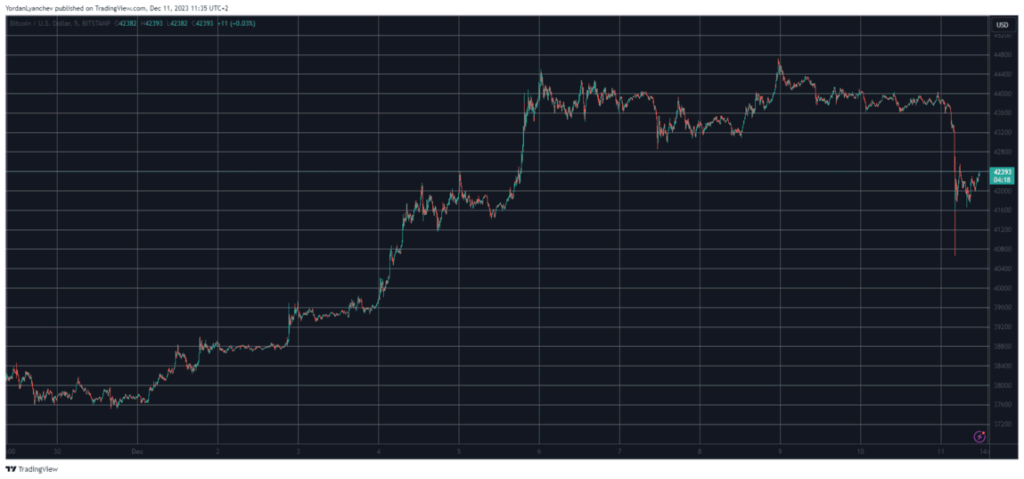

In a startling turn of events, the cryptocurrency market has witnessed a significant downturn, with a staggering $80 billion erased from its total market capitalization. Leading cryptocurrencies such as XRP, ADA (Cardano), DOT (Polkadot), and LINK (Chainlink) have experienced severe declines. Bitcoin, the market leader, has not been spared either, suffering a substantial drop of $3,000, plummeting to a weekly low. This decline has been particularly pronounced in the past 12 hours, indicating a sudden and sharp market correction.

The impact has been widespread, with altcoins bearing the brunt of the downturn. Ethereum, Binance Coin, Solana, Dogecoin, Tron, Polygon, and Shiba Inu have all recorded losses in similar magnitudes. The total crypto market cap, at one point, dipped from $1.640 trillion to $1.560 trillion, highlighting the scale of the sell-off.

Understanding the Market Dynamics

To comprehend this sudden market shift, it’s essential to look at the recent trajectory of cryptocurrencies. Bitcoin, for instance, had an impressive start to December, climbing from under $38,000 to over $44,000, a peak not seen since May 2022. This bullish trend was short-lived, however, as the market underwent a sharp correction, leading to the current scenario.

The reasons behind such market movements are multifaceted. Factors like global economic uncertainties, regulatory news, or large-scale liquidations can significantly impact market sentiment. In this case, over-leveraged positions have led to liquidations worth over $400 million, exacerbating the market’s downturn.

A Personal Perspective on the Market Shift

From my point of view, the recent plunge in the crypto market is a stark reminder of its inherent volatility. While the rapid growth and potential of cryptocurrencies are undeniable, such incidents underscore the risks involved. Investors and enthusiasts must approach this market with caution, understanding that significant gains can often be accompanied by equally significant losses.

On the positive side, such corrections can also be seen as healthy for the market in the long term. They help in weeding out speculative excesses and can provide buying opportunities for long-term believers in the technology and its potential. However, the downside is the impact on individual investors who may not be prepared for such abrupt market movements.

In conclusion, the recent $80 billion plunge in the crypto market is a significant event that highlights the volatile nature of this asset class. While it presents challenges, it also offers lessons and opportunities for those involved in the market. As the crypto landscape continues to evolve, staying informed and cautious will be key for anyone looking to navigate these digital waters successfully.