The Current State of Cryptocurrencies: A Detailed Look

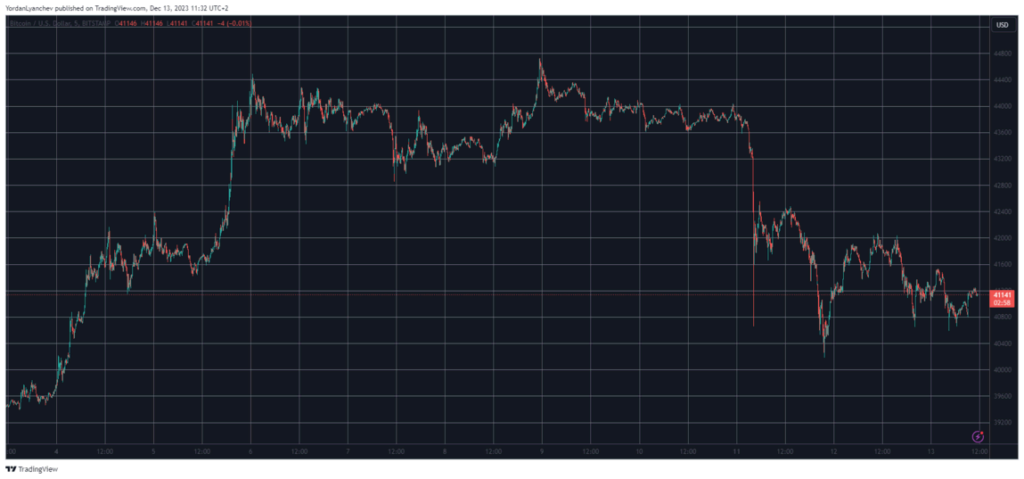

In the ever-volatile world of cryptocurrencies, recent developments have seen significant movements in the market. Bitcoin (BTC), the primary cryptocurrency, has been struggling to maintain its position, hovering around the $41,000 mark. This comes after a recent surge that saw its value peak at $44,700, the highest in over a year and a half. However, the market’s unpredictability was highlighted as BTC experienced a downturn, briefly recovering before slipping again to just over $40,000.

The altcoin sector is also experiencing a downturn, with notable cryptocurrencies like Solana (SOL) and Avalanche (AVAX) facing significant losses. SOL has lost the $70 mark, while AVAX has seen a more than 10% decline in the past 24 hours, dropping below $40. This market behavior is occurring ahead of the last 2023 Federal Open Market Committee (FOMC) meeting, an event that often influences market volatility.

Background and Implications of Market Movements

The cryptocurrency market is known for its rapid fluctuations, and the current scenario is a testament to this characteristic. Bitcoin’s market capitalization has decreased to $805 billion, yet its dominance over altcoins has slightly increased to 52.2%. This shift indicates a complex interplay between different cryptocurrencies and their reaction to global economic indicators.

The FOMC meeting is a critical factor in this scenario. Decisions made in these meetings can significantly impact investor sentiment and market dynamics, as they often influence global economic policies and, consequently, investment strategies in digital assets.

A Personal Perspective on the Crypto Market Dynamics

From my point of view, the current market situation underscores the inherent risks and opportunities in cryptocurrency investments. The volatility of assets like BTC, AVAX, and SOL can be a double-edged sword. On one hand, it presents opportunities for high returns, but on the other, it poses significant risks for investors.

The upcoming FOMC meeting adds another layer of complexity. Investors must navigate not only the unpredictable nature of cryptocurrencies but also the broader economic landscape influenced by monetary policies. This environment demands a balanced approach, weighing the potential for high returns against the risk of sudden market shifts.

In conclusion, the cryptocurrency market remains a challenging yet potentially rewarding field for investors. The fluctuations in BTC, AVAX, and SOL highlight the need for vigilance and a well-thought-out investment strategy, especially in the context of influential economic events like the FOMC meeting. As the market continues to evolve, staying informed and adaptable will be key to navigating its complexities.