The Sudden Fall of Binance Coin

In a startling turn of events, Binance Coin (BNB), a major player in the cryptocurrency market, experienced a significant crash, plummeting over 15% following a recent announcement by the Department of Justice (DOJ). This dramatic fall occurred as BNB attempted to breach the resistance level at $265, only to find a precarious support at $230. The news also coincided with the resignation of Changpeng Zhao (CZ) as CEO, adding to the market’s uncertainty. The key support levels now stand at $230 and $200, with a resistance level hovering around $265.

Unraveling the Background: BNB’s Volatile Path

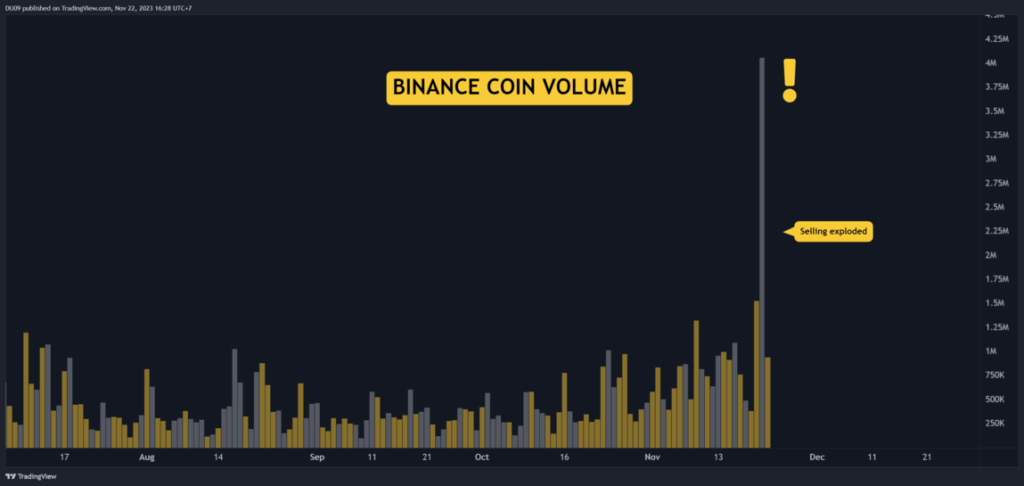

The cryptocurrency market is no stranger to volatility, and Binance Coin has been a testament to this. The recent crash is not an isolated incident but a part of a larger narrative of fluctuating fortunes in the crypto world. The bearish momentum indicators, including a falling daily MACD and lower lows in the RSI, suggest a potential retest of the $230 support level, or even a drop to $200. This downturn was further exacerbated by a surge in sell volume, a reaction not seen since the peak of the bear market in 2022. Despite these challenges, BNB has managed to maintain a position above the crucial $200 mark.

A Personal Perspective on BNB’s Future

From my point of view, the recent events surrounding Binance Coin are a stark reminder of the inherent risks and unpredictability in the cryptocurrency market. The resignation of a pivotal figure like CZ and the DOJ announcement have undoubtedly shaken investor confidence. However, it’s important to note that Binance will continue its operations under new leadership and appears to be financially solvent. This could offer some reassurance to the market in the aftermath of this turmoil.

The bearish bias for BNB, as indicated by the current market indicators, suggests a cautious approach for investors. Yet, the resilience shown by BNB in holding above the $200 support level indicates a potential for recovery. The cryptocurrency market is known for its rapid shifts, and as such, a reversal of BNB’s fortunes could be on the horizon, especially as the market absorbs and moves beyond the recent news.

In conclusion, while the immediate future for Binance Coin seems fraught with challenges, its ability to stay afloat in these turbulent times should not be underestimated. The cryptocurrency market is dynamic and ever-evolving, and BNB’s journey is a testament to this. As the market adjusts to the new developments, it will be crucial to monitor BNB’s performance closely, keeping an eye on key support and resistance levels for potential shifts in the market sentiment.