The Ripple Effect of the Binance-DOJ Settlement

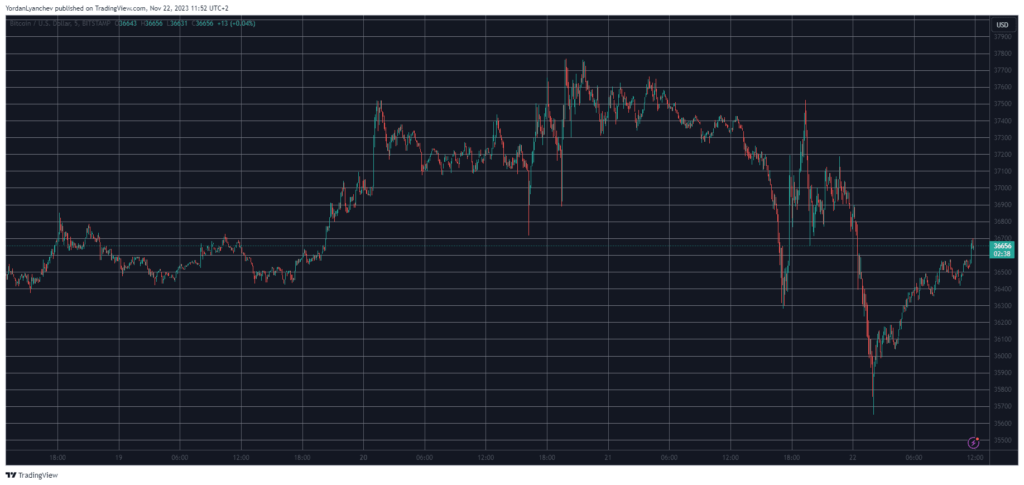

The cryptocurrency market experienced a significant downturn, losing $60 billion in value, following the announcement of a settlement between Binance, one of the largest cryptocurrency exchanges, and the U.S. Department of Justice (DOJ). This news sent shockwaves through the market, with Bitcoin leading the plunge, dropping by almost $2,000 in a matter of hours. Binance’s native token, BNB, was among the hardest hit, plummeting from a five-month high of over $270 to a three-week low of $222.

The settlement, which involved Binance agreeing to pay a hefty $4.3 billion fine and the stepping down of its CEO, Changpeng Zhao, initially seemed to have a positive impact. However, as details emerged, investor confidence waned, leading to a rapid decline in prices. Bitcoin, after attempting to breach the $38,000 mark, fell sharply to $35,600 before making a slight recovery. The market cap of Bitcoin also suffered, dropping to $715 billion, with its dominance over altcoins decreasing.

Understanding the Market Dynamics

The cryptocurrency market is known for its volatility, and the Binance-DOJ settlement is a prime example of how regulatory actions can have immediate and profound effects. Binance, being a major player in the crypto space, has a significant influence on market sentiment. The initial positive reaction to the settlement news suggests that investors were hopeful for a resolution to the ongoing regulatory scrutiny faced by Binance. However, the reality of the hefty fine and the change in leadership raised concerns about the future of the exchange and the broader market.

The impact extended beyond Bitcoin and BNB. Other major cryptocurrencies like Ripple, Solana, Cardano, Dogecoin, and Polkadot also saw declines in the range of 3-4%. This widespread decline indicates a general market reaction rather than isolated incidents, underscoring the interconnected nature of the cryptocurrency market.

A Balanced Perspective on Market Movements

From my point of view, while the immediate market reaction to the Binance-DOJ settlement appears negative, it’s essential to consider the broader context. Regulatory clarity, even when it comes with penalties, can be beneficial in the long term for the cryptocurrency market. It can lead to more stable and mature market conditions, which are necessary for mainstream adoption.

On the downside, such incidents highlight the fragility of investor confidence in the crypto market. The rapid decline in market value following the settlement news underscores the need for a more robust regulatory framework to instill investor confidence and ensure market stability.

In conclusion, while the Binance-DOJ settlement has caused a temporary setback in the crypto market, it could pave the way for a more regulated and stable future. However, it also serves as a reminder of the market’s sensitivity to regulatory news and the need for a balanced approach in navigating the crypto space.